Payroll Coordinator Job DescriptionA payroll coordinator job description outlines the duties and responsibilities of a payroll coordinator, who is responsible for ensuring that employees are paid accurately and on time. This typically includes tasks such as collecting time and attendance data, calculating pay, withholding taxes and other deductions, and issuing paychecks. Payroll coordinators may also be responsible for maintaining employee payroll records, preparing reports, and assisting with payroll audits.In addition to the core responsibilities listed above, payroll coordinators may also be responsible for a variety of other tasks, such as: Processing payroll for multiple companies or locations Preparing and filing payroll tax returns Providing customer service to employees regarding payroll issues Staying up-to-date on changes to payroll laws and regulations Importance and BenefitsPayroll coordinators play a vital role in ensuring that businesses run smoothly. By ensuring that employees are paid accurately and on time, payroll coordinators help to maintain employee morale and productivity. They also help businesses to avoid costly payroll errors and penalties. Historical ContextThe role of the payroll coordinator has evolved over time. In the past, payroll was often processed manually, which was a time-consuming and error-prone process. However, with the advent of computers and payroll software, the payroll process has become much more efficient and accurate. As a result, payroll coordinators are now able to focus on more strategic tasks, such as payroll planning and analysis. Main Article Topics The different types of payroll coordinator jobs The skills and qualifications required to be a payroll coordinator The job market for payroll coordinators The salary and benefits of payroll coordinators The career path for payroll coordinators

1. Key Aspect 1

Accuracy is essential in any payroll coordinator job description. Payroll coordinators are responsible for ensuring that employees are paid the correct amount on time. This means that they must be able to process payroll accurately and efficiently. Even a small error in payroll can have serious consequences for employees, such as financial hardship or even eviction from their homes. In addition, payroll errors can also lead to penalties and fines for the organization.

There are a number of factors that can contribute to payroll errors. These include: Manual errors, such as mistakes in data entry or calculation System errors, such as software glitches or hardware failures Fraud, such as unauthorized changes to payroll records

Payroll coordinators can take a number of steps to minimize the risk of payroll errors. These include: Using automated payroll systems to reduce the risk of manual errors Regularly reviewing payroll records for accuracy Conducting payroll audits to identify and correct any errors* Training employees on payroll procedures

By taking these steps, payroll coordinators can help to ensure that employees are paid the correct amount on time and that the organization is compliant with all applicable laws and regulations.

2. Key Aspect 2

Compliance is a critical aspect of any payroll coordinator job description. Payroll coordinators must be familiar with all applicable payroll laws and regulations in order to ensure that their organization is compliant. This includes laws and regulations governing wages and hours, overtime pay, payroll taxes, and employee benefits.

-

Facet 1: Wages and Hours

Payroll coordinators must be familiar with the federal and state laws governing wages and hours. This includes the Fair Labor Standards Act (FLSA), which sets minimum wage, overtime pay, and recordkeeping requirements. Payroll coordinators must also be familiar with any state laws that may impose additional requirements.

-

Facet 2: Payroll Taxes

Payroll coordinators must be familiar with the federal and state laws governing payroll taxes. This includes the Federal Insurance Contributions Act (FICA), which imposes taxes for Social Security and Medicare. Payroll coordinators must also be familiar with any state laws that may impose additional payroll taxes.

-

Facet 3: Employee Benefits

Payroll coordinators must be familiar with the federal and state laws governing employee benefits. This includes the Employee Retirement Income Security Act (ERISA), which sets minimum standards for employee benefit plans. Payroll coordinators must also be familiar with any state laws that may impose additional requirements for employee benefits.

By being familiar with all applicable payroll laws and regulations, payroll coordinators can help to ensure that their organization is compliant. This can help to avoid costly penalties and fines, and can also help to protect the organization from legal liability.

3. Key Aspect 3

Maintaining the confidentiality of employee payroll information is a critical aspect of any payroll coordinator job description. Payroll coordinators have access to sensitive employee data, such as Social Security numbers, bank account information, and salary history. This information must be kept confidential to protect employees from identity theft, fraud, and other financial crimes.

There are a number of ways that payroll coordinators can maintain the confidentiality of employee payroll information. These include:

- Storing payroll information in a secure location

- Limiting access to payroll information to only those who need it

- Using encryption to protect payroll information

- Shredding or destroying payroll information when it is no longer needed

By taking these steps, payroll coordinators can help to protect employee payroll information from unauthorized access and disclosure.

The importance of maintaining the confidentiality of employee payroll information cannot be overstated. A data breach can have a devastating impact on employees, both financially and emotionally. Payroll coordinators play a vital role in protecting employee payroll information and ensuring that it is used only for legitimate purposes.

4. Key Aspect 4

Effective communication is essential for any payroll coordinator job description. Payroll coordinators must be able to communicate clearly and concisely with employees, managers, and other stakeholders in order to answer questions and resolve issues related to payroll. This includes being able to explain complex payroll concepts in a way that is easy to understand, and being able to provide accurate and timely information on payroll matters.

There are a number of reasons why communication is so important for payroll coordinators. First, payroll is a complex and ever-changing field. There are constantly new laws and regulations that payroll coordinators must be aware of, and they must be able to communicate these changes to employees and other stakeholders in a way that is clear and concise.

Second, payroll is a sensitive issue for many employees. They want to be sure that they are being paid correctly and on time, and they may have questions or concerns about their payroll. Payroll coordinators must be able to communicate with employees in a way that is reassuring and helpful, and they must be able to resolve any issues that may arise.

Finally, payroll coordinators often work with other departments within an organization, such as human resources and accounting. They must be able to communicate effectively with these other departments in order to ensure that payroll is processed accurately and efficiently.

In short, communication is essential for payroll coordinators. They must be able to communicate clearly and concisely with employees, managers, and other stakeholders in order to answer questions and resolve issues related to payroll.

5. Key Aspect 5

Attention to detail is essential for any payroll coordinator job description. Payroll coordinators are responsible for ensuring that employees are paid the correct amount on time. This means that they must be able to pay close attention to detail in order to ensure that payroll is processed accurately.

There are a number of reasons why attention to detail is so important for payroll coordinators. First, payroll is a complex and ever-changing field. There are constantly new laws and regulations that payroll coordinators must be aware of, and they must be able to apply these changes to their work accurately.

Second, payroll is a sensitive issue for many employees. They want to be sure that they are being paid correctly and on time, and they may have questions or concerns about their payroll. Payroll coordinators must be able to review payroll carefully to ensure that it is accurate and that any errors are corrected promptly.

Finally, payroll coordinators often work with other departments within an organization, such as human resources and accounting. They must be able to communicate effectively with these other departments in order to ensure that payroll is processed accurately and efficiently.

In short, attention to detail is essential for payroll coordinators. They must be able to pay close attention to detail in order to ensure that payroll is processed accurately and that employees are paid the correct amount on time.

FAQs on Payroll Coordinator Job Description

This section addresses frequently asked questions about payroll coordinator job descriptions, providing concise and informative answers to clarify common concerns and misconceptions.

Question 1: What are the primary responsibilities of a payroll coordinator?

Payroll coordinators are entrusted with ensuring accurate and timely payment to employees. Their duties encompass collecting time and attendance data, calculating pay, withholding taxes and deductions, and issuing paychecks. Additionally, they maintain employee payroll records, prepare reports, and assist with payroll audits.

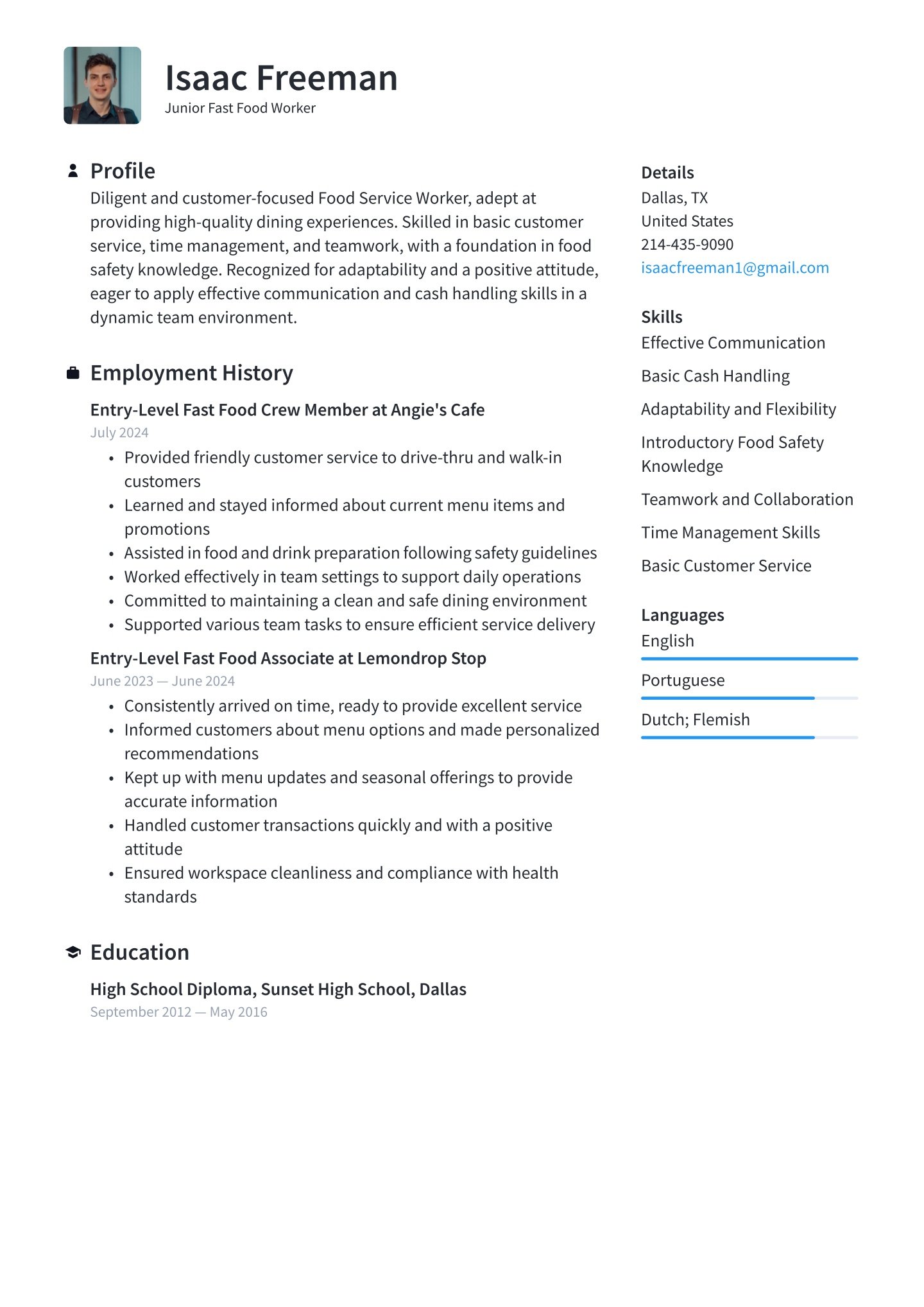

Question 2: What qualifications are typically required for this role?

Typically, payroll coordinators possess a high school diploma or equivalent and several years of experience in payroll processing. Proficiency in payroll software, strong attention to detail, and a solid understanding of payroll regulations are essential. Some employers may prefer candidates with a relevant certification, such as the Certified Payroll Professional (CPP) credential.

Question 3: What is the job outlook for payroll coordinators?

The job outlook for payroll coordinators is projected to grow steadily in the coming years due to the increasing complexity of payroll regulations and the rising demand for accurate and efficient payroll processing.

Question 4: What is the average salary range for payroll coordinators?

The salary range for payroll coordinators varies depending on factors such as experience, location, and employer. According to the U.S. Bureau of Labor Statistics, the median annual salary for payroll and timekeeping clerks, which includes payroll coordinators, was $49,490 in May 2021.

Question 5: What are the key skills and qualities needed to excel as a payroll coordinator?

Payroll coordinators should possess exceptional organizational skills, accuracy, and attention to detail. They must be proficient in payroll software and have a thorough understanding of payroll regulations. Strong communication and interpersonal skills are also valuable for effectively interacting with employees and other stakeholders.

Question 6: What are the potential career paths for payroll coordinators?

Payroll coordinators can advance their careers by pursuing professional development opportunities and gaining experience in related areas. They may transition to roles such as payroll manager, human resources generalist, or accounting clerk. With additional education and experience, they can also qualify for leadership positions in payroll or finance.

In summary, a payroll coordinator job description outlines the essential responsibilities, qualifications, and skills required for this role. Understanding these aspects can guide individuals in evaluating their suitability for a payroll coordinator position and preparing effectively for their career journey in this field.

Transitioning to the next article section: “Essential Duties and Responsibilities of a Payroll Coordinator,” this section delves deeper into the specific tasks and duties typically included in a payroll coordinator’s job description.

Tips for Crafting a Comprehensive Payroll Coordinator Job Description

A well-crafted payroll coordinator job description serves as a roadmap for hiring managers and candidates alike, ensuring a clear understanding of the role’s responsibilities, qualifications, and expectations. Here are some valuable tips to consider when drafting a comprehensive job description for this critical position:

Tip 1: Define Core Responsibilities

Clearly outline the primary duties of the payroll coordinator, such as processing payroll, calculating pay, withholding taxes and deductions, and issuing payments. Specify the frequency of payroll processing and any additional responsibilities, such as preparing reports or assisting with audits.Tip 2: Specify Required Qualifications

Indicate the minimum educational requirements, such as a high school diploma or equivalent. List essential skills and experience, including proficiency in payroll software, attention to detail, and a solid understanding of payroll regulations. Consider including preferred qualifications, such as a relevant certification or experience in a specific industry.Tip 3: Highlight Essential Soft Skills

Emphasize the importance of soft skills, such as strong communication, interpersonal abilities, and a professional demeanor. Payroll coordinators often interact with employees and other stakeholders, so these skills are crucial for building positive relationships and resolving inquiries effectively.Tip 4: Set Realistic Salary Expectations

Research industry benchmarks and consider factors such as experience, location, and company size to determine an appropriate salary range for the position. Providing a clear salary expectation helps attract qualified candidates and ensures transparency in the hiring process.Tip 5: Include Benefits and Perks

In addition to salary, list any benefits and perks offered by the organization, such as health insurance, paid time off, or professional development opportunities. These incentives can enhance the job description’s appeal and attract top talent.Tip 6: Use Clear and Concise Language

Write the job description in a clear and concise manner, avoiding jargon or technical terms that may not be easily understood by candidates. Use action verbs to describe responsibilities and quantify accomplishments whenever possible.Tip 7: Proofread Carefully

Before finalizing the job description, carefully proofread it for any errors in grammar, spelling, or formatting. A polished and error-free document reflects professionalism and attention to detail, which are essential qualities for a payroll coordinator.Tip 8: Seek Feedback and Input

Consider seeking feedback from HR professionals or industry experts to ensure that the job description aligns with current best practices and industry standards. Their insights can help refine the document and make it more effective in attracting qualified candidates.By following these tips, organizations can create a comprehensive and informative payroll coordinator job description that attracts the right talent and sets the stage for a successful hiring process.

In summary, a well-crafted payroll coordinator job description serves as a valuable tool for attracting qualified candidates and ensuring a successful hiring process. By clearly outlining the role’s responsibilities, qualifications, and expectations, organizations can effectively communicate their needs and attract individuals who possess the skills and qualities necessary to excel in this critical position.

Transitioning to the next article section: “Conclusion: The Importance of a Comprehensive Job Description,” this section emphasizes the significance of a well-written job description and its impact on hiring success.